The 2025 Budget, titled “The Restoration Budget: Securing Peace, Rebuilding Prosperity,” was presented by President Bola Ahmed Tinubu during a Joint Session of the National Assembly on Wednesday, December 18, 2024. To date, the budget is yet to receive legislative approval from the National Assembly, marking the latest start to the yearly legislative process for financial appropriation in 25 years. The Chairman of the Senate Committee on Appropriation, Senator Solomon Adeola, attributed the delay to the introduction of the Tax Reform Bill which is required to be passed concurrently with the Appropriation Bill 2025 and without which the underpinning revenue assumption will be doubtful. He further noted that the National Assembly is working diligently to pass the Appropriation Bill by January 31, 2025. In the interim, the National Assembly has approved an extension to the term of the 2024 Appropriation Act from December 31st 2024 to June 2025.

The 2025 Budget represents a significant step toward improving the overall health of the Nation’s economy, restoring macroeconomic stability, and building on the progress recorded by the current administration in the last nineteen months to give the Nigerian economy the much needed uplift.

In his Budget Proposal presentation, President Bola Tinubu outlined the Federal Government’s key priority areas for the 2025 fiscal year, to include restructuring the economy, boosting human capital development, increasing trade and investment volumes, bolstering oil and gas production, and revitalizing the manufacturing sector to enhance Nigeria’s economic competitiveness. He emphasized that defense and internal security, infrastructure development, healthcare, education, human capital development, and agriculture remain at the core of his administration’s fiscal objectives.

The budget proposal is guided by the assumptions set out in the multi-year Medium Term Expenditure Framework (MTEF) 2025–2027 and the Fiscal Strategy Paper (FSP) which serve as a vital tool for prudent fiscal management and resource allocation. The MTEF incorporates factors such as inflation, interest rate, currency exchange rates, foreign exchange reserves, capital import flows, and the performance of the preceding year’s budget to establish the foundational assumptions influencing the fiscal plan for 2025.

Comparative Analysis of Key Budget Assumptions

| 2025 | 2024 | 2023 | |

| Crude Oil Price (Per Barrel) | $75 | $77.96 | $75 |

| Crude Oil Production (MBPD) | 2.06 | 1.78 | 1.69 |

| GDP Growth Rate | 4.6% | 3.88% | 3.75% |

| Inflation Rate | 15% | 21.4% | 17.16% |

| Exchange Rate (USD 1) | NGN 1500 | NGN 800 | NGN 435.57 |

Table 1: Comparison of key assumptions underlying Nigerian budgets from 2023 to 2025

Fig 1: Key Assumptions in the 2025 budget

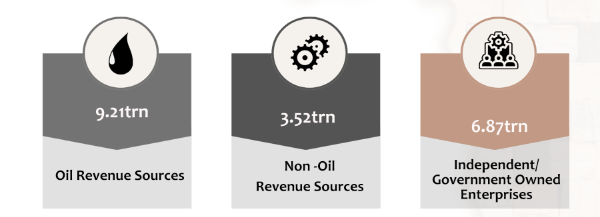

Key Elements of the Budget – Revenue summary

The 2025 Appropriation Bill projects a total revenue of NGN 36.35 Trillion, a 40.51% increase from the total aggregate revenue for 2024.

The total aggregate revenue of NGN36,352,202,174,299 for 2025 is therefore broken down as follows:

- FGN Share of Net Federation revenue is projected to be NGN 27.49 Trillion – (75.56% of the total aggregate expenditure).

- Independent Revenue is projected to be 3.47 Trillion representing – (9.51% of the total aggregate expenditure).

- Other Dividends (less NLNG Dividend) are projected to be NGN 7.52Billion – (0.02% of the total aggregate expenditure).

- Aids and Grants are projected to be NGN 761.9 Billion – (2.09% of the total aggregate expenditure).

- Special Funds/Account Receipts are projected to be NGN 300 Billion – (0.83% of the total aggregate expenditure).

- Revenue from Government-Owned Enterprises are projected to be NGN 2.87 Trillion – (7.89% of the total aggregate expenditure).

- Other Revenue Sources are projected to be NGN 1.46 Trillion – (4.02% of the total aggregate expenditure).

The Medium-Term Expenditure Framework (MTEF) 2025–2027 and Fiscal Strategy Paper (FSP) assumes a total revenue of NGN 34.82 Trillion for 2025:

- Oil-related sources: NGN 19.6 Trillion, representing 56.32% of the total projected revenue.

- Non-Oil-related sources: NGN 15.22 Trillion, representing 43.68% of the total projected revenue, which includes non-oil taxes, mining revenue, GOE revenue, aids, grants, and social fund receipts.

Whilst there exists a marginal discrepancy between the projected revenue in the 2025 Appropriation Bill (NGN 36.35 Trillion) and the MTEF/FSP assumption (NGN 34.82 Trillion), the negligible margin of difference suggests alignment in the fiscal posture of the Federal Government. The almost equal ratio of oil related revenue and non-oil related emphasizes the drive to achieve a more diversified revenue pool, particularly from taxes, government-owned enterprises, and social funds, reinforcing the government’s commitment to a sustainable fiscal mix.

Figure 2: percentage-based representation of revenue projection under the 2025 budget

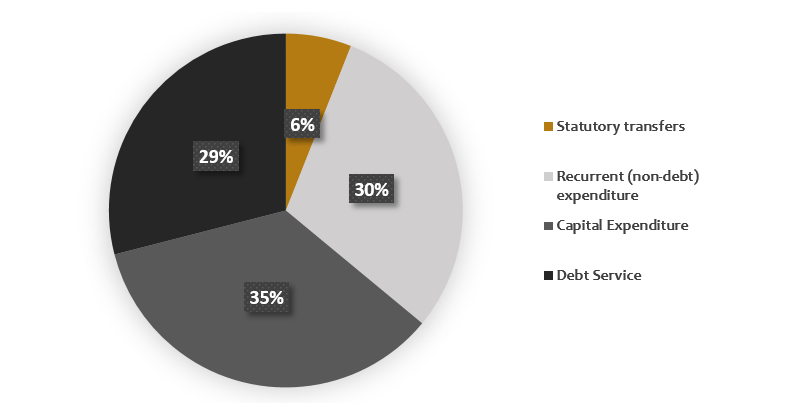

Key Elements of the Budget – Expenditure Summary

The Appropriation Bill 2025 projects a total aggregate expenditure of NGN49.74 Trillion, reflecting a 41.91% increase in comparison 2024, including the approved supplementary budgets.

The projected expenditure for 2025, amounting to NGN49,740,165,355,396, is allocated as follows:

- Aggregate Capital Expenditure is estimated at NGN14.85 Trillion representing 29.85% of the total aggregate expenditure, and a 7.84% increase from the 2024 budget including the approved supplementary budgets.

- Recurrent (non-debt) expenditure is estimated at NGN14.12Trillion representing 28.39% of the total aggregate expenditure, and a 25.40% increase from the 2024 budget including the approved supplementary budgets.

- Total Debt service is estimated at NGN16.33Trillion, representing 32.83% of the total aggregate expenditure, and a 97.81% increase from the 2024 budget including the approved supplementary budgets.

- Statutory transfers are estimated at NGN4.44 Trillion, representing 8.93% of the total aggregate expenditure, and a 154.60% increase from the 2024 budget including the approved supplementary budgets.

Of the total aggregate expenditure approved for the 2025 financial year, a total of NGN8.2 trillion is appropriated for the service of domestic debts and NGN7.6 trillion for the service of foreign debts, while NGN 430.268 billion is to be held in a Sinking Fund Account for the retirement of maturing promissory notes.

Fig. 3: percentage based representation of revenue allocation under the 2025 budget

| 2025 | 2024 | 2023 | |

| Aggregate Expenditure | NGN49.74tn | NGN28.7tn | NGN21.83tn |

| Statutory transfers | NGN4.44tn | NGN1.743tn | NGN967.49bn |

| Recurrent (non-debt) expenditure | NGN14.12tn | NGN8.769tn | NGN8.33tn |

| Capital expenditure | NGN14.85tn | NGN9.995tn | NGN6.46tn |

| Debt service | NGN15.89tn | NGN8.271tn | NGN6.31tn |

| Sinking Fund | NGN430.2bn | NGN223.662bn | NGN247.7bn |

Table 2: YOY Comparison of expenditure allocation in the budgets from 2023 – 2025

Key Elements of the Budget – Budget Deficit and Deficit Financing

The Budget deficit for the 2025 fiscal year stands at NGN13.39 trillion, representing 3.9% of our National GDP and a 45.36% increment from the NGN 9.18 trillion budget deficit for 2024. This sharp increase highlights the Federal Government’s strategic decision to expand fiscal spending in response to pressing national priorities. Although this exceeds the threshold set by the Fiscal Responsibility Act, the Federal Government has represented that the need to address critical security and economic challenges validates this increased expenditure. The Budget deficit is expected to be financed primarily from the proceeds of strategic asset sales/privatization which Federal Government estimates will return circa NGN312,332,810,711 (2% of total deficit); multilateral/bilateral project-tied loans disbursements estimated at NGN3,799,281,435,450 (28% of total deficit) and other debt financing sources estimated at NGN9,276,348,934,936 (69% of total deficit).

The Federal Government’s approach to deficit financing reflects an unprecedented strategy, relying on a domestic and external borrowing threshold. Whilst this strategy will likely facilitate economic growth and development across various sectors, it leaves in its trail growing concerns about rising National debt, layered with rising cost of debt service which could further flay inflationary pressure.

Fig 4: percentage-based representation of the allocation of the budget deficit financing under the 2025 budget

Analysis of the 2025 Budget – Key highlights

- Macroeconomic assumptions

As with previous budgets, questions have been raised around the viability of the macroeconomic assumptions underpinning the 2025 Appropriation Bill. The USD exchange rate benchmark is set at NGN1,500/USD, whereas current market rate hovers around NGN1,535/USD. The gap between the projected and actual exchange rates signals a significant risk, especially if FX availability declines or the FX market conditions worsen. We note however that the Central Bank of Nigeria’s (CBN) Electronic Foreign Exchange Matching System (EFEMS), may likely improve transparency and efficiency in the FX market.

Furthermore, a review of the performance of the 2024 budget reveals discrepancies in inflation assumptions which was projected at 21% for 2024 and which later settled at 34.6%; oil production was pegged at 1.78mbpd, yet actual production averaged 1.4mbpd. These variances have raised significant concerns about the credibility of the 2025 assumptions, especially given persisting challenges such as oil theft, fluctuating global crude prices, and foreign exchange volatility. Critics argue that these overly optimistic assumptions could lead to higher deficits and greater borrowing to cover revenue shortfalls.

- Ambitious Revenue Assumptions

The revenue projections for 2025 have drawn significant scrutiny from experts, with the Federal Government projecting a total revenue of NGN36.35 trillion, representing a 40.51% increase from the 2024 budget revenue projection. This includes projected oil revenue of NGN19.6 trillion, a target that many consider overly optimistic, given Nigeria’s declining oil production volumes of circa 1.6mbpd over the past two years and the persistent challenges of pipeline vandalism, oil theft, and fluctuating crude prices. However, the recent approval of major oil and gas acquisitions, such as the Seplat-Mobil Petroleum Nigeria Unincorporated (MPNU), Oando-Eni, Chappal-Equinor, and Shell-Renaissance deals are expected to increase oil and gas production capacity. These deals, which bring in critical investments for the development of new oil fields and the revitalization of existing ones, are anticipated to help Nigeria achieve higher output levels, and possibly validate the production assumptions.

In the light of the record decline in consumer spending and the growing economic hardship, many stakeholders have also adjudged the Non-oil revenue projections as ambitious. The Federal Government expects NGN15.22 trillion from non-oil sources, including VAT and Corporate taxes. It is however worthy of note that the Federal Inland Revenue Service (FIRS) exceeded its 2024 revenue collection target, realizing NGN21.6 trillion over and above the NGN19.4 trillion target, including significant gains in Company Income Tax and Education Tax.

It is our considered opinion that achieving the 2025 revenue projections hinged primarily on increased oil and gas production, Stabilization of global oil prices and production costs fluctuations in oil prices could directly impact the revenue from this sector and Significantly improve the non-oil revenue stream.

- Debt Financing and Rising Debt Servicing Cost

Under the 2025 Budget, debt service is estimated at NGN16.33 trillion, accounting for 32.83% of total expenditure, significantly higher than the NGN8.49 trillion allocated in 2024. This increase reflects both the rising debt stock and the impact of global interest rate hikes on external borrowings. The fluctuating exchange rate, instability of the Nigerian Naira, and the rise in domestic lending rates further exacerbate the debt servicing burden, as more local currency may be required to meet both foreign and domestic debt obligations.

Nigeria’s growing debt burden continues to be of great concern to stakeholders. The 2025 Budget deficit of NGN13.39 trillion will be financed through a mix of borrowing, multilateral loans, and asset sales/privatization proceeds, further increasing the country’s debt stock. Debt-to-GDP ratio, which stood at 50.7% in 2024 is however projected to decrease marginally to 49% in 2025, highlighting concerns about long-term fiscal sustainability. The high debt-servicing costs will crowd out spending in vital sectors such as healthcare, education, and infrastructure, hindering efforts to achieve inclusive economic growth, thereby calling for an efficient long-term debt management strategy and enhanced fiscal discipline.

- The 2025 Tax Reform Bill

The proposed 2025 Tax Reform Bill, currently undergoing the legislative approval process, is what underpins key revenue assumptions under the 2025 Budget and the Federal Government’s strategy to increase revenue generation and improve fiscal sustainability. This Bill which has been applauded by many stakeholders, shows a much longer term approach to tax reforms in contrast to the previous Buhari administration, which passed a Finance Bill alongside its Appropriation Laws to deliver strategic reforms and stimulate economic activity in priority sectors in each Fiscal Year. The Tax Reform Bill when passed, is expected to enhance tax compliance, streamline fiscal policies, expand the national tax base, and consolidate existing tax laws, whilst delivering long-term fiscal health, and addressing systemic inefficiencies in tax administration and aligning tax policies to the broader fiscal objectives of the Federal Government.

Conclusion

The 2025 Appropriation Bill is an ambitious fiscal proposal designed to restructure critical sectors of Nigeria’s economy, drive revenue growth, and tackle pressing national challenges. Its key objectives include reducing dependence on petroleum imports, promoting the export of finished petroleum products, boosting agricultural production through improved security, and increasing foreign exchange inflows through foreign investments. Further, the budget targets a significant increase in crude oil output and exports while aiming to lower upstream oil and gas production costs. However, the ongoing delay in the budget’s approval by the National Assembly poses the risk of potentially stalling progress on these vital initiatives and delaying the execution of key projects.

Achieving the objectives of the 2025 budget will require a comprehensive and strategic approach by the Federal Government. This includes the rigorous implementation of tax reforms, diversification of the economy to reduce oil dependency, substantial investment in critical infrastructure, and the strengthening of governance frameworks to enhance transparency and accountability. These measures are essential for improving fiscal discipline, attracting investments, and building a resilient economic foundation.

For businesses, subject to its timely passage, we already see key economic benefits that are likely to positively impact the business landscape in Nigeria. The significant increase in capital expenditure is expected to translate to increased infrastructure development; it is also expected that the Country will enjoy a much more stable and predictable fiscal and monetary policy direction which will restore investor confidence and promote economic growth.

The Budget also records significant allocation of revenue to education:- supporting teacher training, supporting initiatives such as the Universal Basic Education, Vocational Training Initiative, the expansion of the National Open University of Nigeria, and the promotion of equal opportunity to education through scholarships and grants to students from disadvantaged backgrounds. This will in the long run improve the size and depth of the Nation’s skilled workforce pool which has suffered significantly on account of increased workforce migration.

In summary, the 2025 budget presents promising opportunities for sectors such as manufacturing, agriculture, education and infrastructure with the increased capital flow to be recorded in the current fiscal year and the overall impact this will have on the overall economy. Nonetheless, businesses must remain proactive and adaptable, keeping a close watch on evolving fiscal policies, potential tax reforms, and macroeconomic indices that may impact their operations. Ultimately, the budget’s success will depend on timely legislative approval, efficient policy execution, and prudent fiscal management. These factors will determine the extent to which the 2025 budget influences Nigeria’s economic trajectory and the broader business landscape.

About DealHQ

We are a Pan-African transactional advisory firm dedicated to enabling businesses operate efficiently within Africa’s dynamic market. We provide stellar business solutions which help businesses navigate the unique challenges and opportunities in the African business landscape whilst enabling them to operate efficiently within their market sphere.

Our service offering includes: corporate commercial, real estate & construction, finance, capital markets & derivatives, mergers and acquisitions, private equity, infrastructure, technovation and data privacy, agriculture & commodities, business formations & start up support amongst others.

The content of this Article is not intended to replace professional legal advice. It merely provides general information to the public on the subject matter. Should you wish to seek specialist legal advice on this or any other related subject, you may contact us.

info@dealhqpartners.com

www.dealhqpartners.com

+234 (0) 201 4536427 , +234 (0) 809 093 8104

Click here to access the pdf file DEALHQ – UNDERSTANDING NIGERIA’S APPROPRIATION BILL 2025

Recent Comments